it is too high or too low relative to peers). Our accounting screen is set to trigger a red flag when fixed assets/sales is below the 20th percentile or above the 80th percentile relative to industry peers (i.e. Small fixed assets can also mean small depreciation charges which flatters profits and may mean that the company has invested very little in tangible assets, despite growing sales or the need to replace worn out machinery. It may also suggest that the company does not own or cannot prove ownership of its fixed assets, hence, it does not book them on its balance sheet. A low level of fixed assets can indicate that a company is actually producing very little, its sales are fake, or it’s acting as an agent rather than the manufacturer it portrays itself to be. This shows that for 1 currency unit of the long-term fund, the company has 0. This might be acceptable in some industries, such as trading companies, but is unusual for the vast majority of industries. It may not be a serious problem if the company has just made an investment in a fixed asset to modernize, for example. We are especially concerned about companies where net fixed asset turnover is extremely low relative to industry peers (i.e. Interpretation: If the fixed asset turnover ratio is low as compared to the industry or past years of data for the firm, it means that sales are low or the investment in plant and equipment is too high. What does this tell you If sales are steady, or increasing from one year to the next.

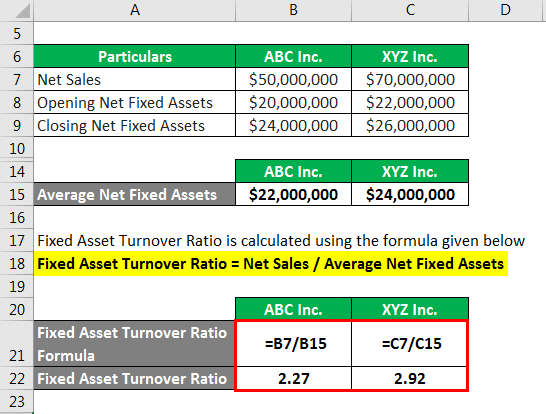

For example, capital intensive industries (such as infrastructure) will have large fixed asset bases resulting in a high ratio in excess of 30x compared to asset light industries (such as IT) which will tend to have low ratios below 10x, as shown in Figure 23. Divide sales by net fixed assets to give the fixed asset turnover ratio. Companies in the same industry should have a similar relationship between net fixed assets and sales although there will be huge differences across different industries. Net fixed asset turnover measures a company's ability to generate sales from its fixed assets. We also penalise any unusually large movements in either direction.

A high fixed-asset turnover ratio does not assure high profits or high cash inflows for the company.We penalise companies that generate sales which are either unusually high or low relative to their net fixed asset base compared to industry peers.

Lower ratios mean that the company isnt using its assets efficiently and most. Hence, there will be a difference in the fixed-asset turnover ratio of both the companies. Higher turnover ratios mean the company is using its assets more efficiently. For example, assume the sales of two companies are the same and the asset base of one company is higher in comparison to the other company. However, there can be some other reasons for a low ratio. The Fixed Asset Turnover Ratio measures the efficiency at which a company is capable of utilizing its long-term fixed asset base (PP&E) to generate revenue. This measure calculates how efficiently a company is using its fixed assets to generate revenue. An increase in the ratio as compared to previous years is a sign of growth.Ī low fixed-asset turnover ratio is not considered good as it indicates that the company is not able to use its fixed assets in earning revenues. Indeed Editorial Team Updated 19 February 2023 It's important to understand the concept of fixed asset turnover when assessing a company's efficiency and profitability. Therefore, the fixed-asset turnover ratio of the current year is compared with the past year's ratio. there is no standard ratio to compare the ratios of the company to. A high ratio is considered good, but there is no exact ratio or an ideal ratio for the fixed-asset turnover ratio, i.e. A high ratio indicates the company is efficient in using its fixed assets. Generally speaking, the higher the ratio, the better, because a high ratio indicates the business has less money tied up in fixed assets for each unit of. The fixed-asset turnover ratio is used in establishing the relationship between the net sales and the net average fixed assets of a company.

0 kommentar(er)

0 kommentar(er)